How do contractors inside IR35 get paid?

Today I’m going to give a high level explanation of how inside IR 35 contractors get paid.

This will give you a simple understanding of the breakdown, and why agents are willing to work with you, and why it’s worthwhile.

Not truly understanding the system may not give you an appreciation for why, and how people work.

With this in mind, let’s get started!

Show me the money

The first time I was exposed to this I was in awe. This is because I was clueless to the reality of it.

However, I realised I was amongst a few that understood this. Now I share it with you.

I’m going to cover the following.

- The flow of money

- Breaking down £500 a day

- Getting paid

So with that said let’s get started!

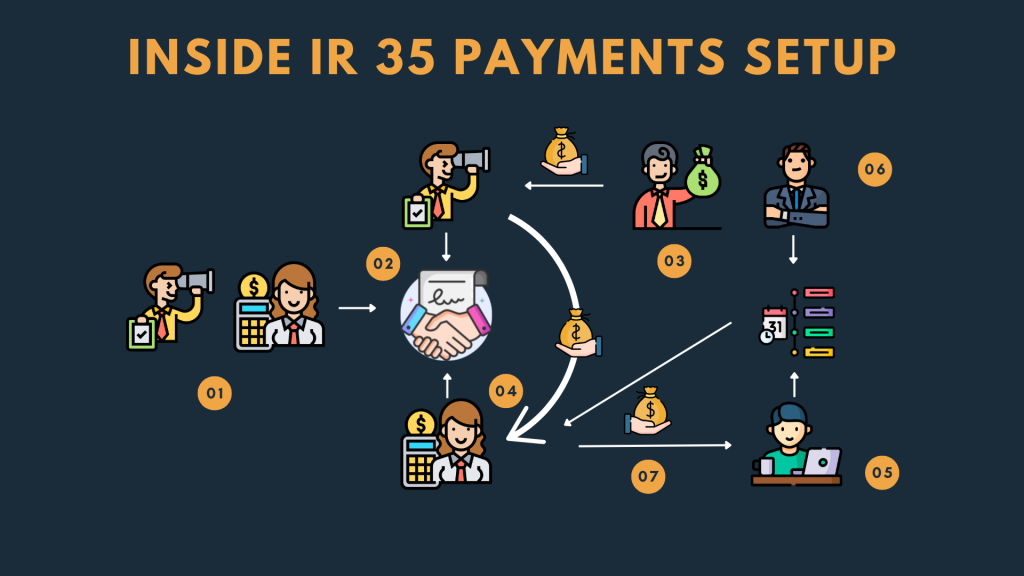

The flow of Money

I’ve written briefly about this before in my newsletter: The dark side of contracting. I will explain it briefly here again.

- When you sign up to an umbrella company and sign their contract, they work with the agency that found the work for you and will sign a contract with them.

- The agency gains commission for acting as the liaison between the end-client, umbrella and contractor. They also collect payment from the end-client and pass it onto the umbrella so that they can pay you. This also means they can get their cut of the pie too.

- This is made possible as you sign a timesheet that is authorised by your hiring manager, lead or manager, using the agencies’ portal.

- Payment is made to the contractor, on time assuming there is no late or inaccurate submissions made by the contractor, that the portal is running smoothly and that the authorised authorise payment within the allocated time window.

- Most payment is made within 1–4 weeks in arrears.

Hopefully this gives a clear understanding of how it works.

Breaking down £500 a day

If you are a permanent employee, £500 per day seems like a lot of money.

Relatively speaking, it is. Without getting into too much of the detail, it is when you are receiving this money pro rata. A lot of contractors do not receive it pro rata as they typically have short term contracts for various reasons.

The sensible, professional and well seasoned contractor is likely to be better off, but it comes with its own risks.

Let’s look at an example of how this money works:

- The end client has an agreed amount of money they can spend

- This gross amount will determine fees paid to everyone and is inclusive of VAT

- They contact agents typically using a procurement framework, an established relationship to help them find contractors

- This is done because contractors are easier to bring, and it takes less time. The idea is also that the contractors sought are hopefully more specialist than their current workforce

- Let’s say the gross amount of money the end client can spend is about £45k for 3 months for a project manager, the maximum day rate the contractor can get is £543.48

- Let’s assume though the rate agreed with the contractor is £500 a day, the agent may agree to take 15% of this which is £75 (these are made up figures) a day + 15% of whatever is left over, in this case it’s the additional £43.48 × 15%, making a total of £81.52 a day

- VAT is also added, which means the end client is paying the following:

- £500 + £43.48 = £543.48

- £543.48 + agency rate of 15% = £625

- £625 + VAT at 20% = £750 per day

- 3 months is 60 working days, making the calculation to be £750 × 5 days per week × 4 weeks a month X 3 months = £45,000

This is a rough calculation and not a perfect science. Sometimes contractors don’t start on time, they take holidays and can be on leave.

There are also contingencies and financial buffers that need to be taken into consideration. This just gives you an idea.

Getting paid

As aforementioned before, payment is facilitated via timesheet submission and authorisation from timesheet approvers.

As the work being carried out is identified as inside IR 35, these contractors are subject to the same taxes as an employee working for an organisation.

This is possible because your umbrella acts as the organisation you are working for, as they process your payment, manage your tax deductibles and provide you with benefits.

Your umbrella company takes into consideration things like:

- National Insurance Employers contributions

- Pension Employers contribution

- Apprenticeship levy

- National Insurance Employee contributions

- Pension Employees contribution

- Umbrella fees per week

Your umbrella will also include things concerning holiday pay as an accrual if you opt in for this, and additional benefits.

An umbrella can be particularly useful for showing continuous employment, and helping when it comes to getting a mortgage. This is what I did.

As you get paid, ensure you develop a rhythm for saving, paying bills and buying what you want. Using pots helps me do this well.

The key takeaways are:

- The flow of money involves agents, umbrellas, and the end client. Your job is to sign your timesheet accurate and make sure your approver does their job on time

- £500 a day is not £500 a day. The end client has a set budget and pays the agent also

- Getting paid includes standard PAYE tax deductibles. The more you understand it the better you can plan

Understanding the money can help you better understand how people operate in the system. In addition, knowing what your

Relatively speaking, you are still better off, even if it isn’t pro rata, but that comes down to your lifestyle and many other factors.

If you want I can help you in the following 3 ways:

- Secure the Job: The step-by-step course that unveils systems, strategies and success when it comes to progressing your job and applying for new roles

- The Independent Consultant UK: A guide to becoming a contractor in the UK. This is a step-by-step walkthrough of my experiences, hosting exclusive information to help you transition into the space of contracting.

- Book a call: Let’s have a chat to focus on your life areas and where you can the biggest impact. If it makes sense, we can progress towards procuring coaching or mentoring.